All Categories

Featured

Table of Contents

- – How Does Bob Diamond Define Success In Claims?

- – What Is A Good Price For Overage Training Trai...

- – What Is The Most Practical Approach To Learni...

- – What Does Bob Diamond Teach About Fund Recovery?

- – What Are The Most Recommended Revenue Recove...

- – How Long Does Fund Recovery Training Typical...

Any kind of continuing to be overage comes from the owner of document immediately before the end of the redemption duration to be claimed or appointed according to legislation - claim management. These sums are payable ninety days after execution of the deed unless a judicial activity is set up during that time by one more plaintiff. If neither asserted nor appointed within five years of day of public auction tax sale, the excess will escheat to the basic fund of the controling body

386, Areas 44, 49.C, eff June 14, 2006. Code Commissioner's Note 1997 Act No. 34, Section 1, routed the Code Commissioner to alter all references to "Register of Mesne Conveyances" to "Register of Deeds" anywhere showing up in the 1976 Code of Regulations.

How Does Bob Diamond Define Success In Claims?

201, Part II, Area 49; 1993 Act No. 181, Area 231. The arrangements of Areas 12-49-1110 with 12-49-1290, inclusive, associating to observe to mortgagees of recommended tax obligation sales and of tax sales of buildings covered by their respective home loans are taken on as a component of this chapter.

Recovering surplus funds from tax sales can appear complicated, but the expert training provided in Bob Diamond’s tax lien overages program provides a clear, step-by-step guide. It starts with explaining how surplus funds are created, to successfully submitting claims, this comprehensive training equips participants with the skills they need to succeed. His blueprint covers essential tactics for connecting with property owners, handling legal documentation, and expanding your recovery efforts for steady returns. This is a rewarding business model for anyone looking to generate income while helping others reclaim funds that are rightfully theirs.Authorities may nullify tax obligation sales. If the authorities in cost of the tax obligation sale finds before a tax title has actually passed that there is a failure of any type of action required to be effectively performed, the official might nullify the tax obligation sale and reimbursement the quantity paid, plus interest in the amount actually gained by the area on the quantity refunded, to the effective bidder.

HISTORY: 1962 Code Section 65-2815.14; 1971 (57) 499; 1985 Act No. 166, Section 14; 2006 Act No. 386, Areas 35, 49. Code Commissioner's Note At the instructions of the Code Commissioner, the first sentence as amended by Area 49.

Agreement with region for collection of tax obligations due town. A region and community might acquire for the collection of municipal tax obligations by the area.

What Is A Good Price For Overage Training Training?

In enhancement, the majority of states have regulations influencing proposals that surpass the opening quote. Payments over the county's standard are known as tax obligation sale overages and can be successful financial investments. The details on overages can produce troubles if you aren't aware of them.

In this post we tell you how to get checklists of tax obligation overages and make money on these possessions. Tax obligation sale excess, also called excess funds or premium quotes, are the quantities proposal over the beginning price at a tax obligation public auction. The term describes the bucks the investor spends when bidding above the opening quote.

What Is The Most Practical Approach To Learning About Real Estate Workshop?

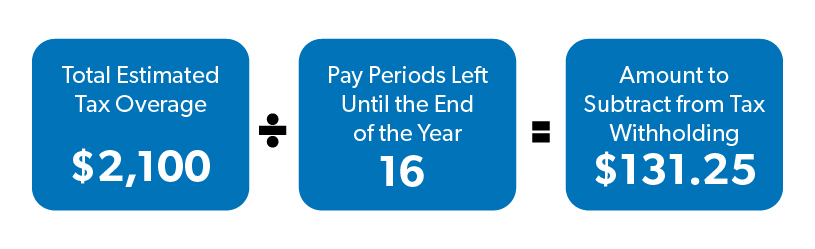

This starting figure shows the taxes, costs, and passion due. After that, the bidding process starts, and several financiers increase the rate. You win with a proposal of $50,000. The $40,000 rise over the original quote is the tax sale overage. Asserting tax obligation sale overages indicates obtaining the excess cash paid during an auction.

That claimed, tax obligation sale overage cases have actually shared features across most states. Throughout this period, previous proprietors and home mortgage holders can get in touch with the area and obtain the overage.

What Does Bob Diamond Teach About Fund Recovery?

If the duration ends prior to any type of interested events declare the tax sale overage, the county or state generally absorbs the funds. Past owners are on a rigorous timeline to claim excess on their properties.

, you'll earn rate of interest on your entire proposal. While this aspect does not imply you can claim the excess, it does aid minimize your costs when you bid high.

Keep in mind, it might not be lawful in your state, implying you're limited to collecting interest on the overage - investor network. As mentioned above, a financier can locate ways to benefit from tax sale overages. Because rate of interest income can apply to your entire proposal and past proprietors can assert overages, you can leverage your expertise and devices in these situations to make best use of returns

A vital aspect to keep in mind with tax sale overages is that in many states, you only need to pay the county 20% of your total quote up front., have laws that go beyond this policy, so once more, research your state legislations.

What Are The Most Recommended Revenue Recovery Resources?

Instead, you just require 20% of the proposal. If the home doesn't redeem at the end of the redemption period, you'll need the remaining 80% to acquire the tax obligation action. Because you pay 20% of your quote, you can make interest on an overage without paying the complete rate.

Once again, if it's legal in your state and county, you can function with them to aid them recoup overage funds for an extra fee. You can gather interest on an overage proposal and bill a fee to enhance the overage insurance claim process for the previous proprietor.

Overage enthusiasts can filter by state, county, property type, minimum overage quantity, and maximum overage amount. As soon as the data has actually been filteringed system the enthusiasts can choose if they wish to add the miss traced information bundle to their leads, and after that spend for only the validated leads that were found.

How Long Does Fund Recovery Training Typically Last?

In enhancement, just like any kind of other investment approach, it offers one-of-a-kind pros and disadvantages. claim management.

Table of Contents

- – How Does Bob Diamond Define Success In Claims?

- – What Is A Good Price For Overage Training Trai...

- – What Is The Most Practical Approach To Learni...

- – What Does Bob Diamond Teach About Fund Recovery?

- – What Are The Most Recommended Revenue Recove...

- – How Long Does Fund Recovery Training Typical...

Latest Posts

Paying Back Taxes On A Foreclosure

Tax Lien Investing Reddit

Is Investing In Tax Liens A Good Idea

More

Latest Posts

Paying Back Taxes On A Foreclosure

Tax Lien Investing Reddit

Is Investing In Tax Liens A Good Idea